The headquarters of the private companies RIVA and Robni Terminal on the outskirts of Tuzla is teeming with life. Their building is located at the customs terminal where freight forwarders and customs officers organize arriving trucks and imported goods every day.

Around the 20th of the month, it is particularly busy, as the workers of these companies come to collect their earnings. One by one, they enter the office on the second floor of the building, where they stay for a short time and then leave with a blue envelope, as eyewitnessed by CIN reporters in September 2022.

These two companies are owned by Abdulah Avdagić from Tuzla and his daughter Amila. Today they have six companies with almost seven hundred employees. They did not want to discuss the envelopes with the reporters. Damir Alagić, their lawyer, says these were not salaries, but gifts that the Avdagić family, as a good employer, have been giving to their employees during the coronavirus pandemic.

However, the current and former employees, some of whom have worked for them for ten years or more, did not see the cash in the envelopes as a gift. Nine of them told CIN reporters that they have been receiving one part of their salary in cash from the very first day of their employment. All except lawyer Emir Baraković wished to stay anonymous, fearing reprisals from their employers.

“You need money to live, you have bills to pay, you need to bring food to the table, to make a living. For this reason, not only I, but all other people agreed to the part of the salary in the envelope. You simply have no choice”, said Baraković, a former employee of RIVA.

By paying them part of the salary in cash, Avdagić reduces the workers’ creditworthiness and the pension they will receive while depriving the state of income.

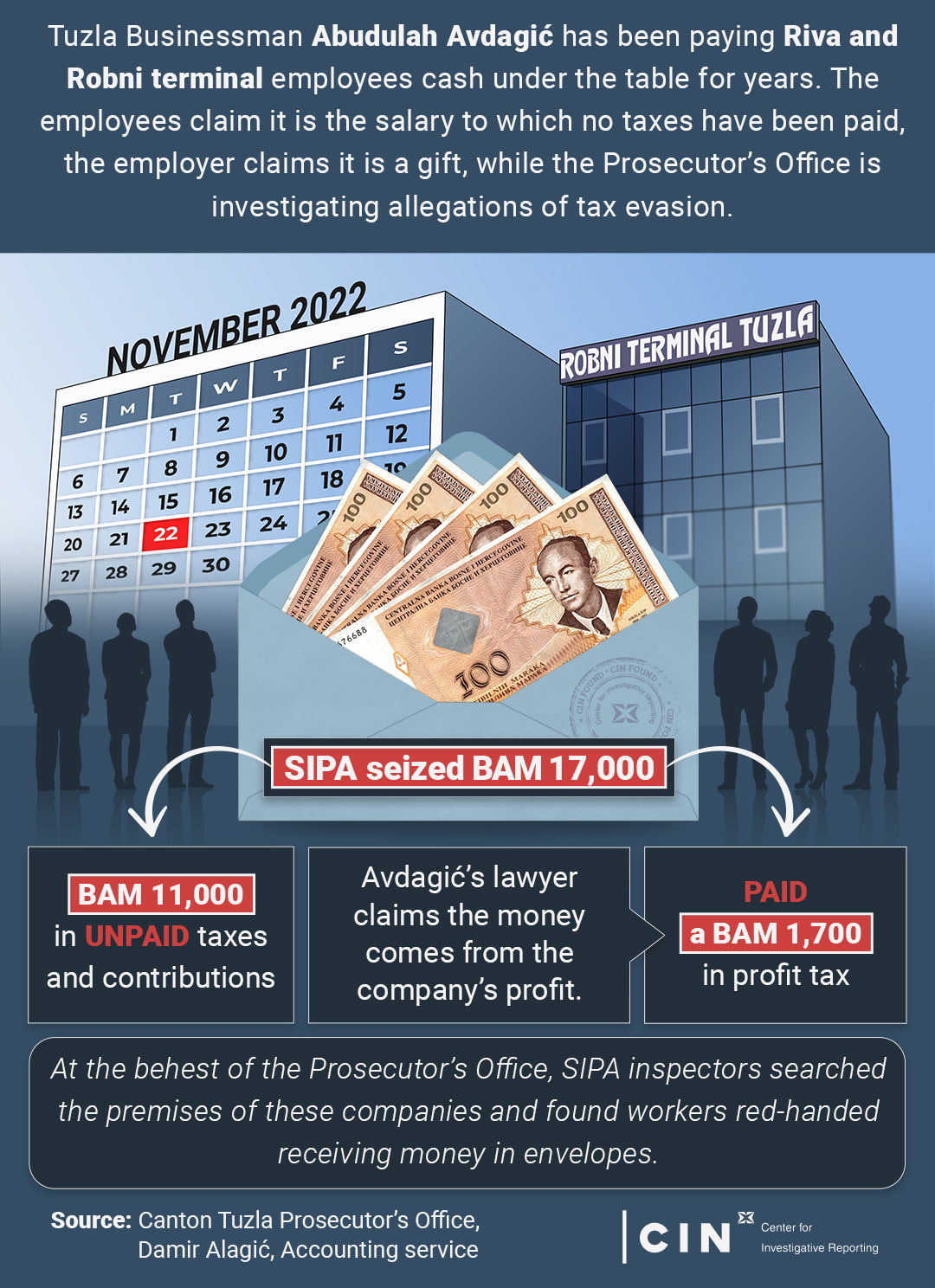

Two months following the visit of CIN reporters, inspectors of the State Investigation and Protection Agency (SIPA) raided the RIVA offices and found workers red-handed receiving money. The inspectors confiscated BAM 17,000 distributed in envelopes. Taxes and contributions payable to this amount would have been about BAM 11,000. The Tuzla Canton Prosecutor’s Office is investigating the allegations of tax evasion.

“They have evidence for the corona pandemic only,” said lawyer Alagić for CIN, underscoring that the money was a gift.

“Millionaires who are paying minimum wage to people – paying a gift each month, it’s ridiculous… It’s not a gift, it’s a salary in an envelope”, said Baraković.

An earned gift

Abdulah Avdagić founded the company RIVA in 1991 with his parents. Originally registered under the name Riva Komerc, the company was mainly engaged in distribution, wholesale, and retail. Over the years, the Avdagić family expanded their business by opening sister transportation and service companies throughout Bosnia and Herzegovina (BiH), a gas station, and kiosks.

Lawyer Emir Baraković worked at RIVA for a year and a half as a retail manager. His job was to organize the work of about a hundred kiosks.

He left the company in the spring of 2021 because he could not stand the pressure: “Why do people go on breaks? Why the turnover here isn’t as big? You should spy on them, watching when they close and open kiosks. What are they doing? They just drink coffee at kiosks. (…) – Scolding was a business policy of the company.”

Baraković claims he was paid BAM 1,300 marks to his bank account, plus BAM 500 in cash.

Monthly pay slips of Riva and Robni terminal employees that were shared with the reporters contained the following lines: “agreed salary”, “payment via bank” and “envelope”. Amounts paid through the bank and cash in the envelope add up to the agreed salary.

In addition to Baraković, eight more employees confirmed to CIN to have been receiving part of the salary in an envelope each month over the entire period of their employment – BAM 30 to 500 in cash, and BAM 440 to 1,800 to their bank accounts.

They agreed to talk only if their identities would remain anonymous:

“Part of the salary in cash is paid between the 21st and 25th of a month. It is subject to their goodwill if the payment will be made on the 21st, 22nd, or 25th. (…) Zlata (author’s note: Zlata Avdagić) distributes it in her office. She locks herself that day in the office and she fills the envelopes with the money that each of us should get.”

“It’s like we begging for charity.”

“Towards the end of the day, around three o’clock, the secretary would call us to come and collect the envelopes”.

“We sign the slip to have received this part of the salary, and that’s it.

A month later, CIN reporters filmed the workers entering the secretary’s office and leaving with blue envelopes. In the meantime, Baraković collected the statements of former colleagues and reported Avdagić to the Prosecutor’s Office for violating labor rights and tax evasion.

Shortly after receiving the report, SIPA raided the RIVA offices during the distribution of envelopes and seized evidence, including signed lists of payments.

Lawyer Alagić could not hide his anger at his client Zlata Avdagić for preserving the evidence: “She kept it in her desk. She is the one who always… Here, she must know how much of their money they give to the workers.”

According to Alagić, the BAM 17,000 SIPA seized is the money taken each month out of the owner’s profit to which he paid a 10% tax to the state. According to the calculation made by the accounting bureau at the behest of CIN, the profit tax is one-sixth the size of the tax and contribution liability they ought to pay for workers.

The lawyer kept insisting that the workers received a tax-free gift in the envelopes: “And there is nothing illegal about it!”

He says that by sharing profits, his clients have introduced a novelty in BiH in order to save workers: “It is also in their interest, and it is their goodwill to give people the money the way they did.”

The workers also claim to have often worked overtime but such work has not been recorded in the company’s official books. “We would produce one timesheet for them, and another for the inspection authorities”, says an employee who worked at the kiosk from 10 to 12 hours a day. In her case alone, the court expert determined that in 2020 she worked 302 hours more than what she was paid.

Also, most of CIN’s interlocutors were fixed-term employees. They rarely protested because they could lose their jobs at any moment:

“I’ve never had a contract for more than three months. … That builds pressure a month before the expiry of the contract. I felt as if I had a bomb in my lungs that kept growing, and growing.”

“Working 10-12 hours a day, plus responsibilities at home (…) such work dynamics renders you physically present but voiceless.”

“I had a mild nervous breakdown. I went to the doctor’s and asked for help because I was no longer in control of myself.”

Burden of proof

“Salary in an envelope” is a term that most citizens in Bosnia and Herzegovina are familiar with. Yet, financial inspectors have no mechanisms to prevent it.

The Tuzla Canton Labor Inspectorate often receives reports, but they say that they cannot do anything about them because the term “salary in an envelope” does not exist in the Labor Law, hence no response to it has been foreseen.

“I really do not know how to define it. It’s not a salary. It’s an internal agreement that two people render for whatever reason,” said Ivana Banović-Osmanović, chief cantonal labor inspector.

Also, the Federation of Bosnia and Herzegovina Tax Administration inspectors can hardly prove the salary in the envelope because the documents presented to them by the owners contain no record of the cash payments.

“The only way to prove these facts in the inspection process is through the statements of employees about the actual wages received,” says the FBiH Tax Administration.

In addition to other evidence, the Cantonal Prosecutor’s Office also has the testimonies of Avdagić’s workers, who ultimately ventured to take this step.

“It’s not so simple… There is fear of what will be tomorrow. Do you understand? They are powerful people, and the ordinary people are the scapegoats”, said one of the former employees of the RIVA company.

Mario Nenadić, director of the 22,000-member Association of Employers of the Federation of BiH says that Avdagić is not their member. According to him, the Association does not deal with “salaries in an envelope”, as this is the job of the judicial institutions.

Nenadić, however, finds no justification for this: “When it comes to the current system, there are many things that we disagree with. The system as a whole is extremely cumbersome for businesses, the taxes and contributions are too high, yet, none of this justifies such transgressions.”

Lucrative business with the state

This is not the first time that Avdagić was under the scrutiny of investigators. In the early 2000s, the FBiH Customs Administration reported the director of Riva Komerc three times to the Cantonal Prosecutor’s Office of the Una-Sana Canton (USK) for smuggling Ronhil and Boss cigarettes in the post-war years.

He denied smuggling, and during the investigation, he claimed he did not know the drivers who transported the cigarettes, even though the documents stated that his company was an importer.

The building at the terminal located at the periphery of Tuzla, in addition to Avdagić employees, accommodates employees of the Indirect Taxation Authority, Veterinary Inspection, and freight forwarders.

At the time of the formation of the BiH Indirect Taxation Administration (ITA BiH) in 2004, Avdagić founded the Robni terminal company and built a customs terminal intending to rent it to the newly established institution.

However, things did not go so smoothly. In that period, ITA BiH insisted on investigating the cigarette smuggling, supplementing the reports until 2007, when the USK Prosecutor’s Office abandoned the investigation against Avdagić due to a lack of evidence. Already the following year, the company Robni terminal entered a deal with ITA BiH leasing them a parking lot and office premises for the customs terminal.

According to the ITA BiH data, this company made BAM 8.5 million from 2010 to 2020 from leasing the space.

In 2000, Avdagić also privatized the company Proizvodno-trgovinski kombinat in Tuzla. He bought a company and a four-story office building for about half a million mark, which today is worth almost three times more. He leases one floor to the Ministry of Agriculture, Forestry and Water Management of Tuzla Canton for an annual rent of BAM 91,500.

The Avdagić family also owns the company Duhan promet in Sarajevo, which has more than a hundred tobacco shops throughout Bosnia and Herzegovina. Also, through the companies RIVA and Proizvodno-trgovinski kombinat, they co-own the Special Hospital Medical Institute Bayer in Tuzla with a capital of around five million marks. In neighboring Croatia, more specifically in Makarska, they have a transportation company Riva Com Trade. During the coronavirus pandemic, they opened the Riva oil gas station in Tuzla.