Last July a group of citizens who communicated via Internet forums in Germany exposed a grand share fraud that involved people from Bosnia and Herzegovina (BiH).

The fraud was allegedly run by Dunmorr Group AG, and phone calls touting opportunities to buy West European companies shares originated in BiH, Germany and Monaco.

Reporters from the Center for Investigative Reporting in Sarajevo (CIN) found that the majority owner of Dunmorr is Goran Samardžija, a BiH citizen who lives in Belgrade. His firm is incorporated in Switzerland with branch offices in BiH and Serbia.

Dunmorr’s Bosnian branch has been the focus of an investigation by the BiH Prosecutor’s Office which said in a press statement Monday that the police agencies of the Republika Srpska and the Federation of BiH have arrested more than 70 persons in Sarajevo, Banja Luka and Bihać in an operation code-named Perač (the Launderer). They are suspected of an organized fraud of citizens, money laundering and tax evasion.

The forum participants said that behind Dunmorr was an organized network of people who introduced themselves as representatives of Titan Invest offering shares of various firms floating on the stock exchange. Enormous profits were promised to citizens ready to invest in the offered shares.

Dunmorr would buy large amounts of shares in worthless firms that their Bosnian employees then offered en mass to EU buyers. They artificially generated interest in the shoddy shares which led to their fast rise on the stock exchange. After the sales frenzy, interest in the shares dropped and the shares quickly lost value.

The naive buyers were left, unable to sell worthless shares to anyone else.

This March a girl named Jelena wrote on a German web forum that she worked for two days in Dunmorr’s newly opened branch office in Banja Luka. She warned that this was probably a fraud because her employers wanted her and other employees to call telephone numbers all day long and read a text in German offering shares.

Dunmorr Group was incorporated in 1997 in Glattburg, Switzerland, under the name of Selab and with the founding capital of 20,000 Swiss Francs.

Swiss natives Alfred Ariger von Litau and Antonio Odesti von Gansingen, each with shares of 10,000 Swiss Francs founded the business. And Fiedrich Auf der Maur acted as their business advisor. In the beginning the firm developed and distributed software and traded in commodities.

After von Litau died,, his family and the co-owner sold the firm in 2000 to de Maur. The bill of sale reads that they got 500 Swiss Francs each. In 2001 Maur moved the firm to Zurich.

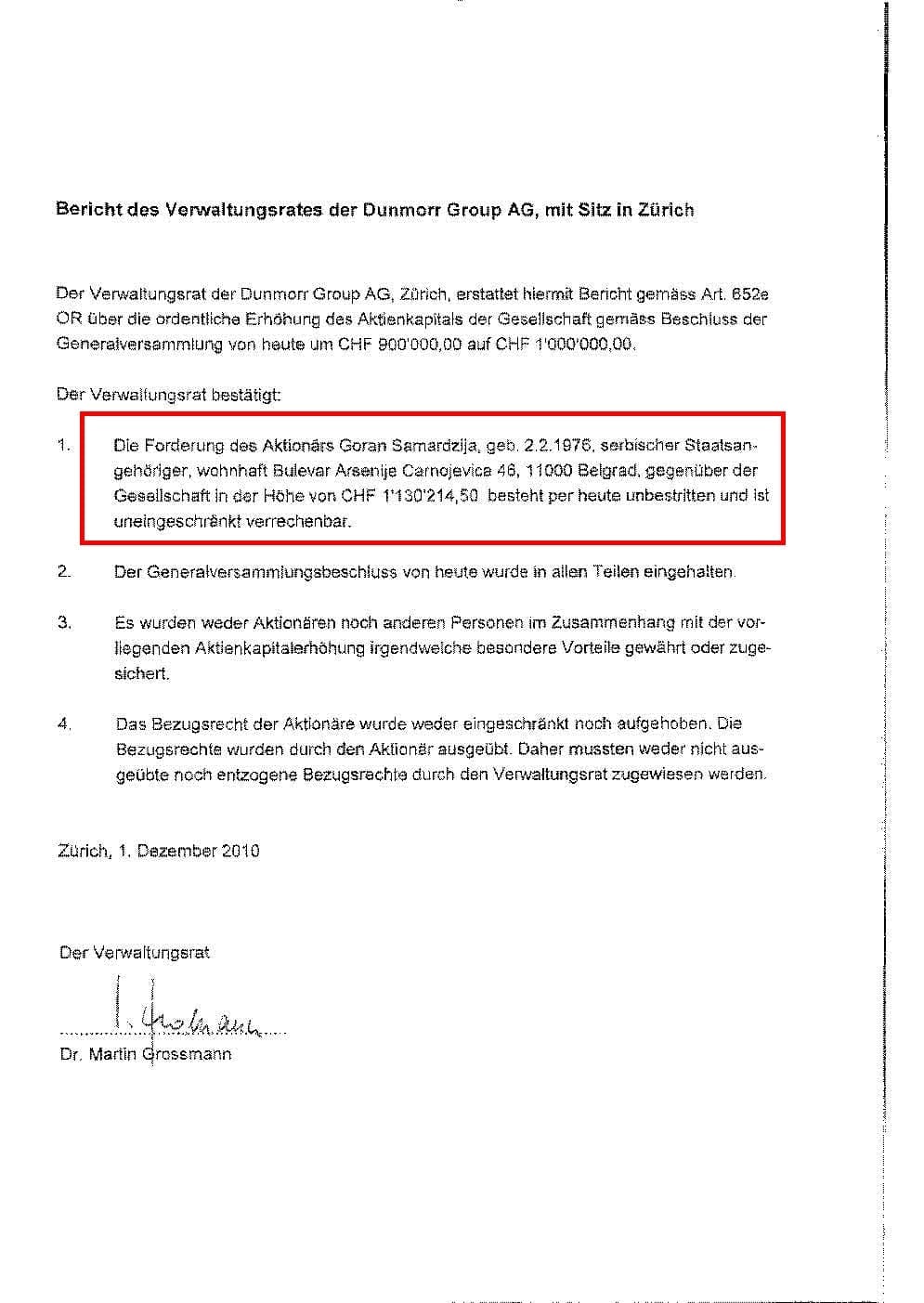

In May 2002, Maur reregistered the firm Selab as a shareholder society and increased its capital to 100,000 Francs. The next year the firm again changed its owner when Martin Grossmann from Zurich took it over. He also changed the firm’s classification of services to the trade of agricultural products from Eastern European states as well as the development of agricultural products in Eastern Europe.

The firm’s name was changed to Dunmorr Group AG at the end of 2007. Martin Grossmann again changed the classification of the firm’s services and it became involved in financial consulting and appreciation of firms on stock exchange. Apart from this, the number of shares increased while its nominal value decreased and the firm’s capital was divided into 1,000 shares worth 100 Francs.

By 2009, Grossmman was the only shareholder and board member. Then he brought on board a 29-year-old Zoran Samardžija, BiH national with a residence in Dusseldorf, Germany.

During 2010, a Belgrade-based Goran Samardžija recapitalized the firm by investing more than 1.13 million Francs. This has enabled him to earn 9,000 shares and increase Dunmorr Group’s total of shares to 10,000. It is unclear what the exact relation between Goran and Zoran Samardžija is.

Zoran Samardžija was appointed tpresident of the Board of Directors, while Grossmann became a member.

In 2008, Goran Samardžija incorporated Stonehard Consulting LLC in Serbia that also dealt in business consulting.

Since November 2009, this firm has been blacklisted by FINMA, the Swiss agency for oversight of financial market. The list features Swiss and foreign companies considered risky.

Stonehard Consulting was liquidated in June 2010.