Key Points:

- An executive appointed by the liquidators for Mriya Agro said the firm signed almost identical contracts with eight shell companies and the bank “should have asked questions.”

- Creditors, including institutional investors and suppliers, are suing members of the Guta family and in December 2021 liquidators filed a request for arbitration in Switzerland, accusing Credit Suisse and others for failing to meet due diligence requirements.

- Cypriot firms owned by the Gutas, one of which was a co-signatory on a Guta-held Credit Suisse account, purchased expensive real estate in Germany and Spain.

- Credit Suisse appears to have kept the Guta accounts active even after the scandal began unfolding.

In late 2014 Mriya Agro Holding Public Limited, one of Ukraine’s largest grain producers, collapsed after admitting it could not meet its financial obligations. Owned and run by members of Ukraine’s wealthy Guta family, Mriya was placed into liquidation in Cyprus, where it was registered.

In the years that followed, it emerged the Gutas had drained huge sums of cash out of Mriya and moved the money into offshore shell companies they owned. As they did so, the family used two of these companies to acquire and develop a luxurious villa in the mountains of Bavaria, once described as the priciest on the German market.

Now, new leaked bank data from the Suisse Secrets project confirms over half of the money was embezzled from a Mriya company account at Credit Suisse, with the rest taken from Mriya’s Bank of Cyprus account. The Gutas, who now live in Switzerland, were signatories on the Credit Suisse account, along with senior staffers at Mriya.

Mriya’s collapse left a number of creditors out of pocket, including institutional investors like BNY Mellon, the International Finance Corporation of the World Bank, Deutsche Bank AG and Credit Suisse itself, which was owed almost 12.8 million euros.

German taxpayers were impacted too. With Deutsche Bank stung for 40 million euros, and two other smaller German lenders also affected, the German state stepped in, paying over 30 million euros to compensate these firms.

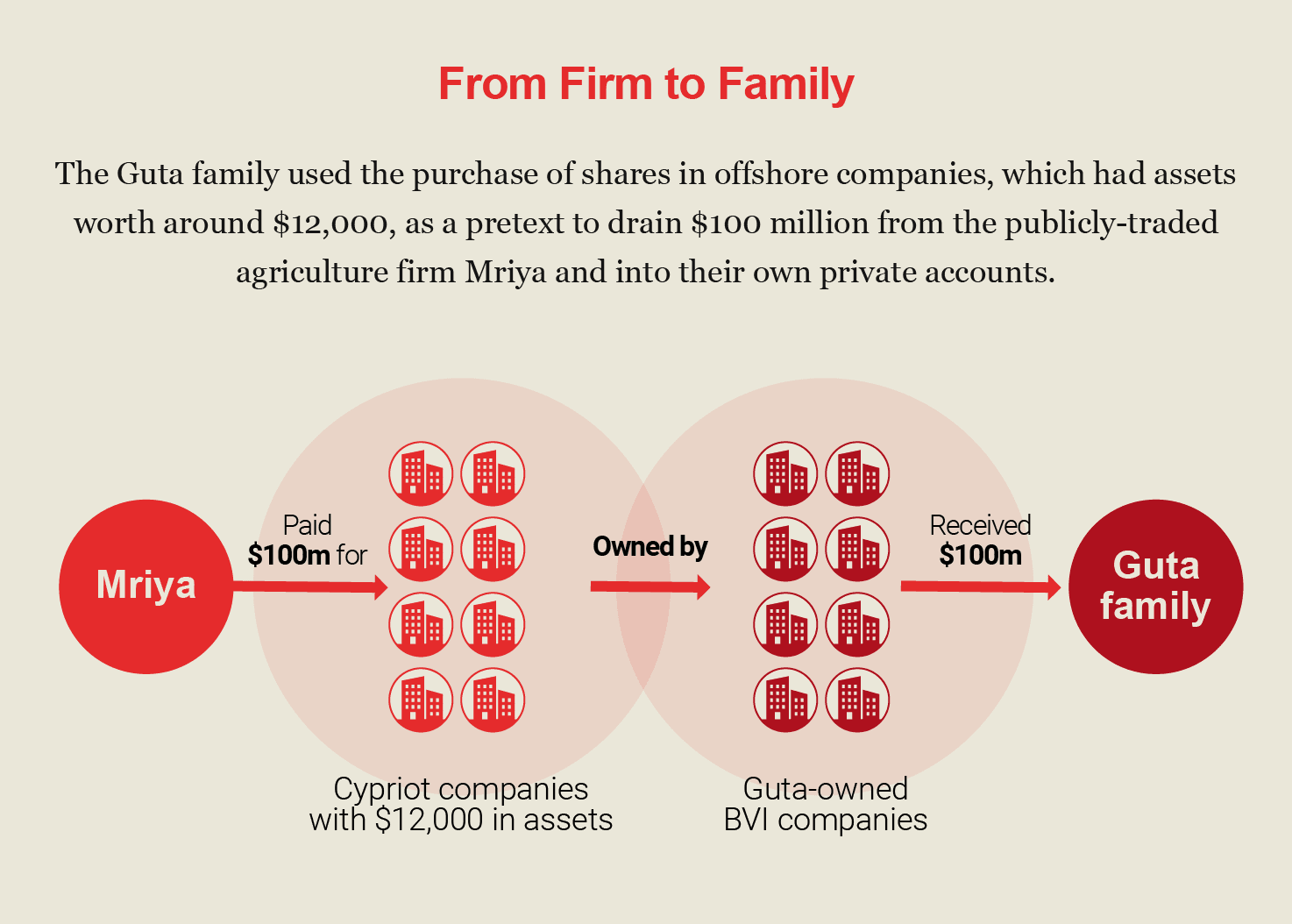

An investigation ordered by Mriya’s team of liquidators found that between October 2011 and December 2013, the company paid more than $100 million for shares of eight Cypriot shell companies, despite these firms holding assets worth roughly $12,000 combined.

Mriya paid the funds to eight companies in the British Virgin Islands (BVI), each of which owned the shares of one of the Cypriot firms. The eight BVI companies were owned by members of the Guta family, according to court documents. In most instances, the BVI companies did not even transfer the shares to Mriya.

Thanks largely to this scam, by 2014 Mriya had been stripped bare.

“[T]he purported share purchases were in fact a sham and merely a way to siphon millions out of [Mriya],” Mriya liquidators Chris Iacovides and Andri Antoniou wrote to creditors in a June 2020 letter. “The beneficial owners of the BVI seller companies were members of the Guta family and the shares paid for were of no and/or negligible value.”

Now, an analysis of court documents and data from the Suisse Secrets leak shows that not only was Credit Suisse potentially culpable in facilitating the financial bloodletting at Mriya, but the perpetrators of the scheme maintained several other accounts with Credit Suisse. An arbitration document from December 2021, exclusively obtained by OCCRP, accuses Credit Suisse of due diligence failures under Swiss money laundering legislation.

Ton Huls, the former chief financial officer at Mriya, who was tasked with sorting out the chaos the Gutas left behind, said the banks should have noticed the funds were moving from Mriya, a large publicly traded company which the Gutas controlled, to small shell companies they also owned.

The Suisse Secrets Investigation

Suisse Secrets is a collaborative journalism project based on leaked bank account data from Swiss banking giant Credit Suisse.

The data was provided by an anonymous source to the German newspaper Süddeutsche Zeitung, which shared it with OCCRP and 46 other media partners around the world. Reporters on five continents combed through thousands of bank records, interviewed insiders, regulators, and criminal prosecutors, and dug into court records and financial disclosures to corroborate their findings. The data covers over 18,000 accounts that were open from the 1940s until well into the last decade. Together, they held funds worth more than $100 billion.

“I believe that Swiss banking secrecy laws are immoral,” the source of the data said in a statement. “The pretext of protecting financial privacy is merely a fig leaf covering the shameful role of Swiss banks as collaborators of tax evaders. This situation enables corruption and starves developing countries of much-needed tax revenue.”

Because the Credit Suisse data obtained by journalists is incomplete, there are a number of important caveats to be kept in mind when interpreting it. Read more about the project, where the data came from, and what it means.

Mriya Agro Holding was established in 1992 by Ivan Guta (also sometimes spelled “Huta”) and his wife, Klavdiya, after the Ukrainian government granted the couple 50 hectares of arable land in western Ukraine.

The company expanded due partly to a contract to supply potatoes to Ukrainian and Russian Black Sea fleets in the mid-1990s. The Gutas’ sons, Andriy and Mykola, joined the business, and by 2012 the company reported that it had expanded the land under its management to almost 300,000 hectares — an area bigger than Luxembourg.

But Huls has said these figures were inflated and likely the result of questionable calculations.

“This year we are operating our complete land bank which is more than 160,000 hectares,” Huls said after liquidators took over Mriya. “The 300,000 hectares which [previous management] announced were never found.”

Huls added that he would “call it almost a “Ponzi scheme.”

In 2008, 20 percent of Mriya’s stock began trading on the Frankfurt Stock Exchange. The family maintained control of 80 percent of the company via the BVI-registered HF Asset Management Limited, in which each family member held a 25 percent stake.

The Main Account

Suisse Secrets data shows that members of the Guta family were signatories on 13 corporate and three personal accounts opened at Credit Suisse between November 2008 and December 2013.

The Mriya corporate account with the largest balance (222.9 million Swiss francs, or around $243 million) was used in five instances to purchase shares in the fraudulent Cyprus companies.

All four members of the Guta family were signatories to this account, along with two other people who appeared to be Mriya staff.

In the arbitration document obtained by OCCRP, liquidator Chris Iacovides said the Gutas used the Mriya account at Credit Suisse only to transfer money from one place to another. Around December 19, 2011, for example, $37.9 million entered the account. Days later, $21 million was paid out to two BVI companies owned by the Gutas. A similar pattern occurred two years later, when the account received $7.9 million on a single day in December 2013 before quickly transferring $8 million in two installments to a Guta-owned BVI shell company.

Other Guta accounts at Credit Suisse held maximum balances ranging from a couple of thousand to several million Swiss francs. Outside the main account used for the Cypriot share purchases, the largest sum in any single account in the data was almost 44.9 million Swiss francs. This balance was recorded on April 30, 2013, by which time the family had extracted over $92 million from Mriya, court documents reveal.

Accounts at Bank of Cyprus received the lion’s share of the money that left Mriya’s account at Credit Suisse, according to court documents obtained by OCCRP. Only the last of the eight transactions followed a different route: The payment for the eighth Cypriot company was sent to an account at the Latvian Regional Investment Bank in Riga, but only $8 million of the $30 million price tag of the paper Cypriot company was transferred.

The Latvian Regional Investment Bank did not respond to questions from reporters.

Liquidators found that several transactions did not have supporting documentation, raising questions about whether Credit Suisse and Bank of Cyprus had performed due diligence in processing the transfers.

“There was fraud committed by the company. The banks should have asked questions,” said Huls, Mriya’s former chief financial officer.

The share sales contracts were almost identical and in some cases provided for the entire fee to be paid in advance, “which is absolutely not common in such transactions,” said Huls, who has worked in banking for 15 years’.

Huls told OCCRP the transactions with the BVI companies were part of a wider pattern of abuses that may have cost the company significantly more than the $100 million paid for the Cypriot company shares.

“We calculated that this way the Gutas took out some $220 million [from Mriya],” said Huls. “Some $100 million went via Bank of Cyprus, all the rest went via Credit Suisse or other banks.”

In an emailed response, Credit Suisse declined to answer specific questions about its clients. The bank said it was “deeply aware of its responsibility to clients, and the financial system as a whole to ensure that the highest standards of conduct are upheld.”

In recent years Credit Suisse has taken a series of significant measures in line with Swiss financial reforms, “including considerable investments in combating financial crime,” the bank said, adding that it “continues to strengthen its compliance and control framework.” It said the Suisse Secrets project “appear[s] to be a concerted effort to discredit the bank and the Swiss financial marketplace.”

Bank of Cyprus denied all allegations of wrongdoing, which it described as “false and without substance.”

“[T]he various matters in question are the subject of legal proceedings, and therefore the Bank cannot comment further,” it said.

The Gutas, contacted via their lawyers in Cyprus, did not respond to requests for comment.

Ironically a report by Credit Suisse itself from 2012 highlighted the risk that tight family ownership of companies could hurt corporate governance.

“Family businesses tend to do well by having a long horizon and ‘skin in the game’ but they also lack in corporate governance,” Alexander Michaelides, professor of finance at Imperial College Business School in London, told OCCRP.

“It’s not enough for bank analysts to talk about corporate governance risks of family businesses in public,” he added. “They also need to make their colleagues at compliance aware of these risks.”

Hot Properties

The signatory on one Guta account at Credit Suisse was Oihro Ventures Limited, a Cypriot shell company used by the family to acquire real estate in Germany.

The shell company purchased a property in a Bavarian ski resort town for 3.3 million euros in 2010. Using 16 million euros in loans, the property was developed into what Deutsche Welle described in 2018 as “the most expensive home on the German market.”

In 2016 another Cypriot company, Zapatoustra Holdings Limited, owned by Mykola Guta’s wife Viktoriya, became the owner of the luxury residence, named Villa Glory.

A month after the Deutsche Welle report was published, there was an attempt to sell the property for 8.6 million euros, but it was thwarted at the last minute after a Cypriot court issued a freezing order, recognized in Germany, following a civil action brought by the Mriya liquidators.

The Gutas also appear to have invested in real estate in Spain.

The liquidators identified a Spanish property purchased in 2008 for 2.9 million euros by Gibrion Limited, a Cyprus-registered company beneficially owned by the Gutas. The arbitration document obtained by OCCRP claims that over $97 million was transferred from Mriya’s accounts at Credit Suisse and Bank of Cyprus to Gibrion in the space of approximately six months in 2012. The document calls the link between Mriya and Gibrion a “fictitious business relationship.”

The property in Spain was sold to an unspecified third party in November 2018, after it was first transferred to Klavdiya Guta in July 2017, before creditors were able to take action.

Legal Remedies

On behalf of the Mriya creditors, the liquidators sued members of the Guta family in 2018, demanding more than $100 million in compensation.

As well as immediate Guta family members, the liquidators are suing the wives of Andriy and Mykola Guta. They have also laid charges against the eight Cypriot companies involved in the scam, their parent companies in the BVI, and former managers of Mriya, as well as two Cypriot administrative service providers and a Cypriot law firm.

In 2020, the liquidators filed a lawsuit against Bank of Cyprus for more than $48.5 million in damages, citing a “breach of statutory duty” by the bank.

In October 2021, Bank of Cyprus was fined 277,000 euros by the Central Bank of Cyprus, the island’s bank regulator. In a November 2021 letter to creditors, Mriya’s liquidators claimed that the penalty was based on a complaint they had filed in March 2016.

The liquidators told OCCRP they are also considering legal action against Credit Suisse if they don’t win an out-of-court settlement they’re pursuing through arbitration.

In December 2021, a former Mriya financial director pleaded guilty to fraud charges and was sentenced to two and a half years in prison, though the sentence was suspended for three years after the court found he had not benefited from the fraud.

Despite this addition to the list of the Gutas’ alleged crimes, no family member has yet been charged. Since the collapse of Mriya, the Gutas have continued to live in Switzerland. Mykola Guta was briefly extradited to Ukraine in 2018, according to media reports, but has since returned to Switzerland.

Cyprus had European arrest warrants issued against the Gutas in 2019, followed by an international Red Notice in 2020, but its request to Swiss authorities for the Gutas’ extradition remains pending.

The OCCRP’s story READ HERE.